We’ve been helping businesses revamp their operating models by setting up future-ready shared service centres and optimizing operational costs by up to 60%.

Scaling staffing businesses for 20+ years

Transforming businesses by offering end-to-end recruitment solutions

Integrating technology with industry expertise to ease the hiring process

Ensuring EEOC, OFCCP, SOC2, and other compliance regulations

ROI

Yearly Growth

Audit Score

Avg. Compliance Maintained

From understanding your job requirement to onboarding the correct candidate, we specialize in offering a holistic recruitment process.

Learn MoreFocusing on meeting set KPIs & optimizing ROI, we support staffing companies in finding, screening, and submitting candidates quickly.

Learn MoreWe are equipped to fill permanent, temporary, and contract job requisition by delivering available and qualified candidates as per your specific criteria.

Our team is available 24*7 to manage all your back-office, compliance, and admin tasks so that you can focus on your core business and save time.

Learn MoreFrom establishing and managing a robust payroll and billing process to meeting your overall finance & accounting needs, we deliver comprehensive, custom F&A services for agencies.

Learn More

Achieve up to 40% labor arbitrage savings

Free up time so that you can focus on your core business.

Access a team of 500+ experienced recruitment staff

To help scale & transform your business.

Achieve operational excellence with end-to-end solutions

To maintain your data & information security standards

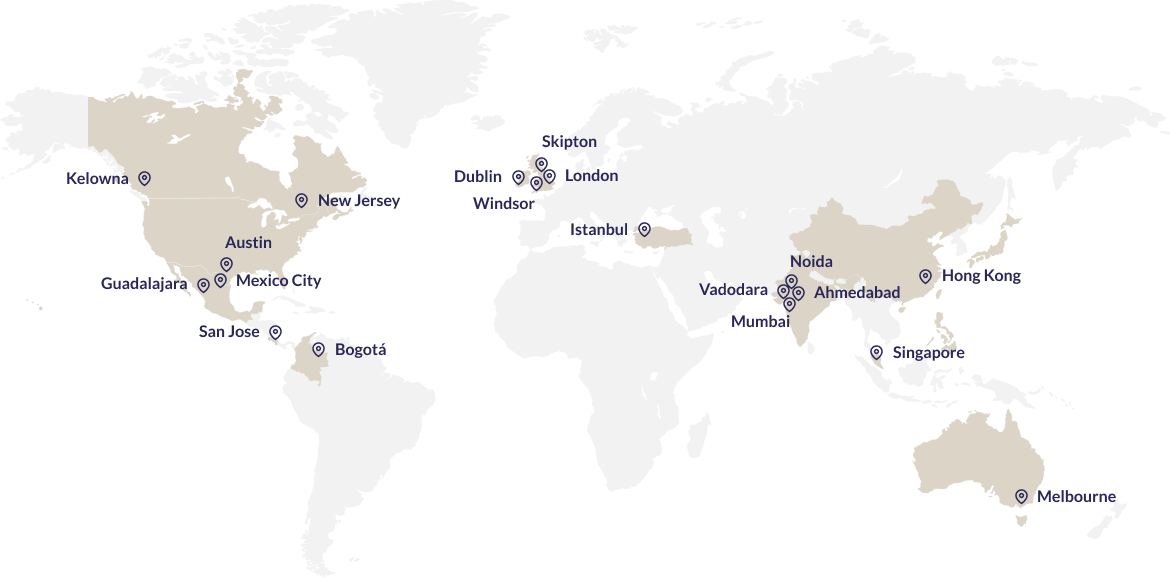

We are a global team of culturally diverse people who collaborate to drive our clients’ scalability, innovation, and success.

Global Workforce

Delivery Centers

Enterprise Clients

Recruitment Staff